r&d tax credit calculation uk

Well Handle The Entire Process For You. Multiply that average by 50.

R D Tax Credit Calculation Examples Mpa

You May Be Eligible For A Tax Credit Offset Use Our RD Tax Credit Calculator Find Out.

. The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA. Subtract the result of Step 2 from the companys. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table.

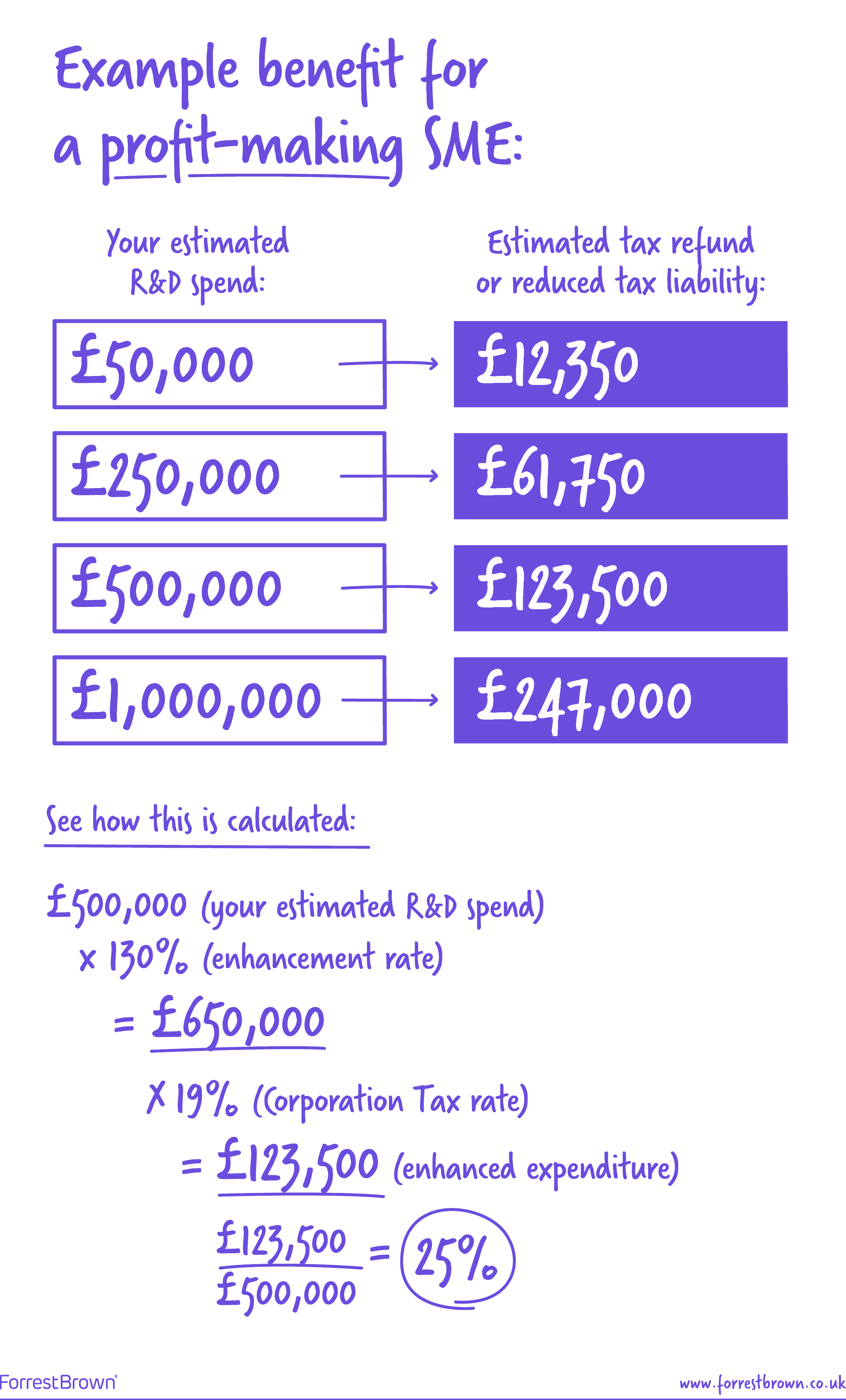

To put it another way 75000 of the expenditure has already attracted relief and. ForrestBrown is the UKs leading specialist RD tax credit consultancy. This calculation example shows how RD tax credits can benefit a.

So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. Enhanced RD qualifying spent would be now 325000 x 130 which makes the revised loss of 275000. Show how this example is calculated.

First however the fix-based percentage must be obtained by. We estimate you could receive up to. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they.

Ad Utilize Our RD Tax Credit Calculator To Estimate Your Potential Tax Credit Deduction. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. If youre a loss-making business youll receive your RD tax credit in.

Calculate how much RD tax relief your business could claim back. Company X made profits of 400000 for the year calculate the RD tax credit saving. If you add back the qualifying costs of 125000 the company would have a profit of 75000.

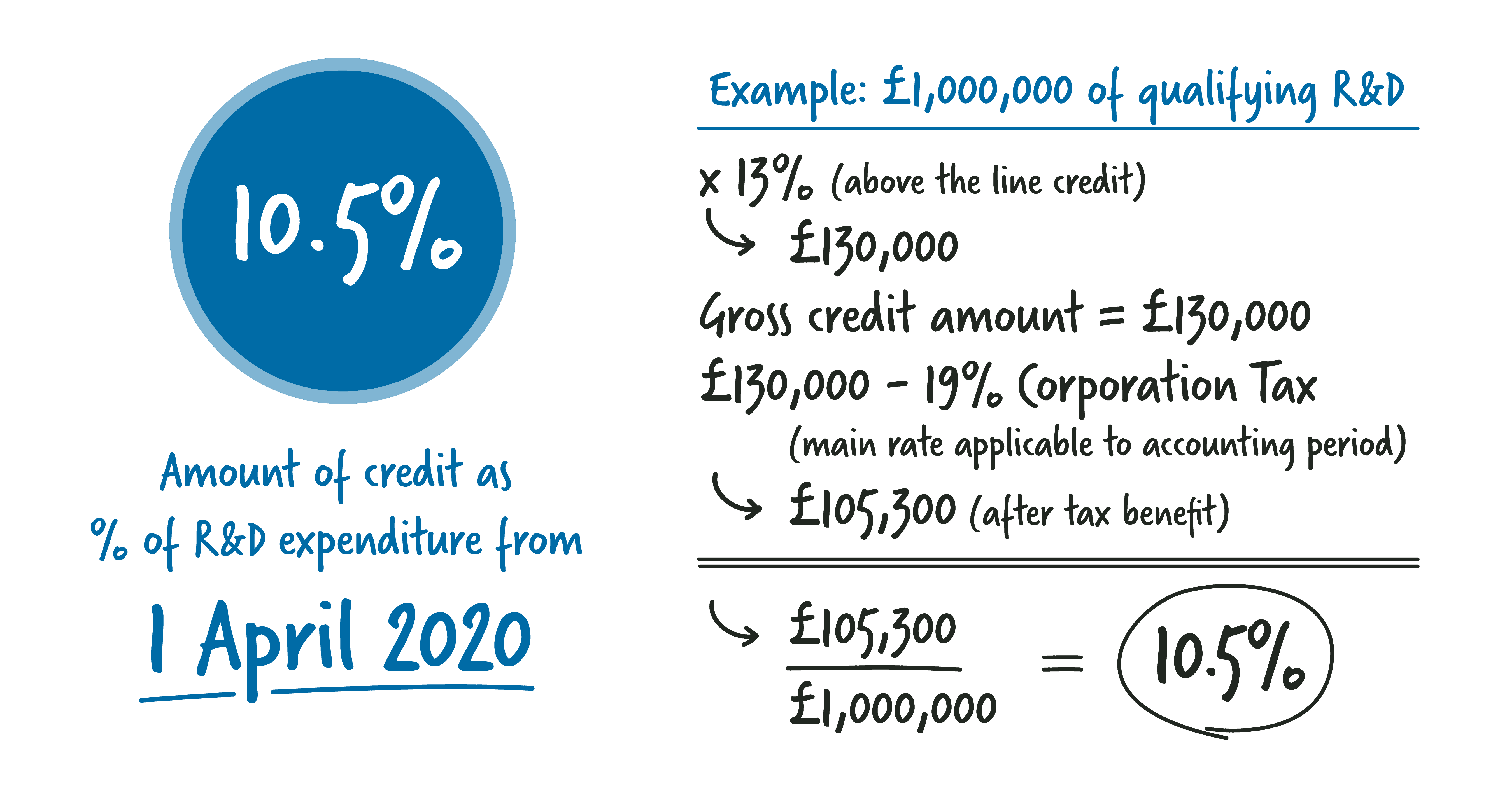

12 from 1 January 2018 to 31 March 2020. The RDEC is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. If the company spent 100000 on RD projects in a year.

Average calculated RD claim is 56000. Surrender of losses in return for payable tax credit up to 33 of qualifying expenditure For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss. The qualifying expenditure is 100000 thats already in accounts as expenditure.

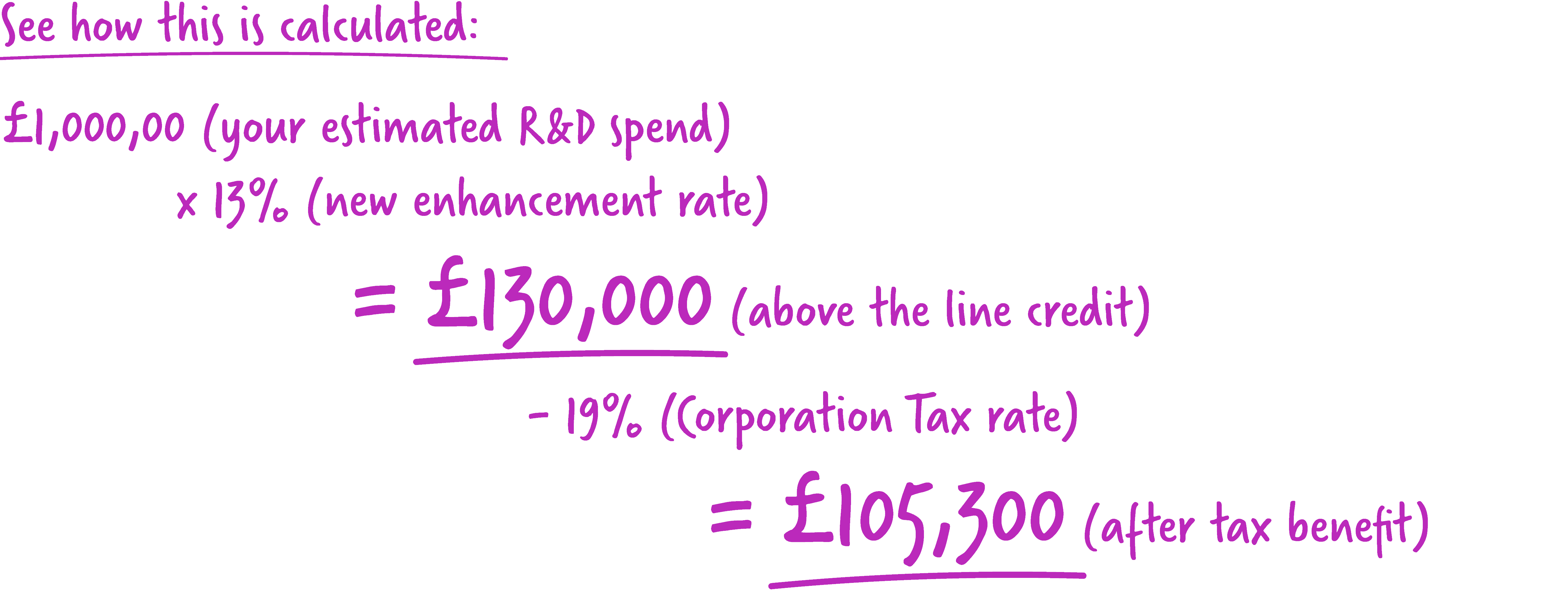

The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable. Use our simple calculator to see if you.

Ad Utilize Our RD Tax Credit Calculator To Estimate Your Potential Tax Credit Deduction. Contact us to find out how much RD tax benefits could be worth to your business. Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors.

Free RD Tax Calculator. As a tax benefit. ForrestBrown is the UKs leading specialist RD tax credit consultancy.

Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. It was increased to. Busineses In Technology Ecommerce Bio-Tech More Can Qualify.

1000000 x 12 120000 above. The initial credit equaled 25 percent of a corporations research spending in excess of. Ad Pilot Helps Your Business Maximize Savings.

The rate of relief is 25. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. You May Be Eligible For A Tax Credit Offset Use Our RD Tax Credit Calculator Find Out.

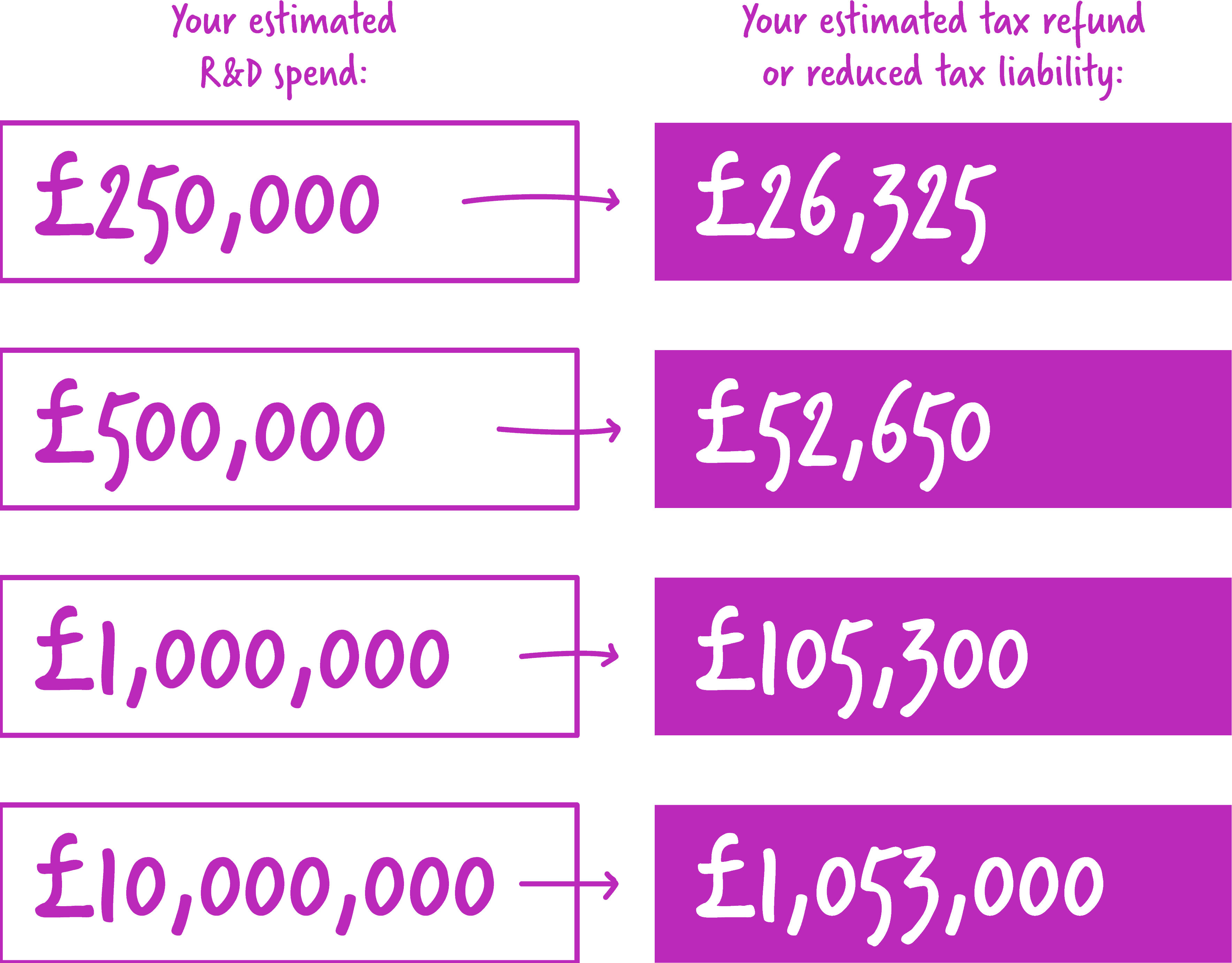

Figure the companys average qualified research expenses QREs for the past three years. See If You Qualify. RDEC Scheme calculation that was either profit or loss making and spent 1000000 on qualifying RD activities in a given year.

Calculating The R D Tax Credit Randd Tax

Rdec Scheme R D Expenditure Credit Explained

Stock Vector Tax Calculation Flat Composition With Budget Planning Financial Charts On Computer Screens On G Financial Charts Budget Planning Gray Background

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

Personal Finance Icons Set Collection Includes Simple Elements Such As Personal Income Mortgage Appro Credit Card Icon Platinum Credit Card Mortgage Approval

How Is R D Tax Relief Calculated Guides Gateley

Most Frequently Asked Questions About The R D Tax Credit Answered Warren Averett Cpas Advisors

R D Tax Credit Calculation Examples Mpa

Auditing Tax Accounting Concepts Concept Accounting Logo Business Icon

R D Tax Credit Rates For Sme Scheme Forrestbrown

Stock Image Business Finance How To Apply Bookkeeping Services Business Finance

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Advance Funding Early Access To Your R D Tax Credit Mpa

R D Tax Credit Rates For Rdec Scheme Forrestbrown

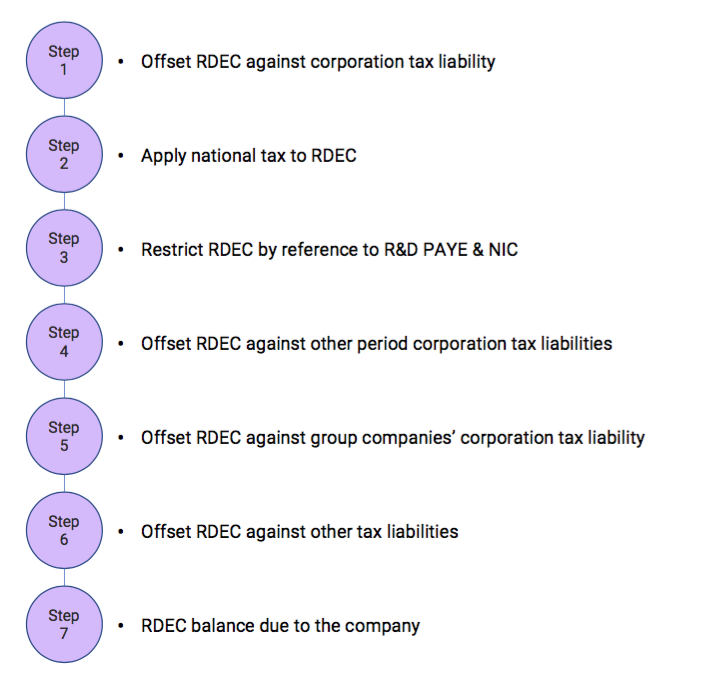

Rdec 7 Steps R D Tax Solutions

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process